long island tax rate

In 2018 the average millage rate in the county was 264 mills which would mean annual taxes of 7920 on a 300000 home. The minimum combined 2021 sales tax rate for Long Island City New York is.

County Surcharge On General Excise And Use Tax Department Of Taxation

Average SALT deductions 1758097.

. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875. Rules of Procedure PDF Information for Property Owners. How to Challenge Your Assessment.

The New York state sales tax rate is currently 4. Its no secret that Long Island property taxes are high. To learn more call 631-761-6755.

Comparatively Long Islands average annual property tax amount in 2016 was. 4 rows Long Island City NY Sales Tax Rate. The minimum combined 2022 sales tax rate for Nassau County New York is 863.

The Nassau County sales tax rate is 425. Queens and Brooklyn have better options but towns further into Long Island in Nassau and Suffolk County have head-spinning property tax costs. The New York sales tax rate is currently.

High Taxes in Long Island New York reduce property taxes. The average effective tax rate is approximately 211 which means taxes on that same home are likely closer to 6330 annually. Also Nassau Suffolk counties.

The sales tax rate on Long Island is the highest in. This rate includes any state county city and local sales taxes. Total SALT deductions In thousands 126583.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 157 rows Average real estate tax 1062715. Average Sales Tax With Local.

How much are taxes in Long Island. The County sales tax rate is. The latest sales tax rate for Suffolk County NY.

But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income. While the average effective property tax rate in Manhattan is just 088 and the statewide average rate is 169 Nassau County and Suffolk County average over 2 according to SmartAsset. What is the sales tax rate in Long Island City New York.

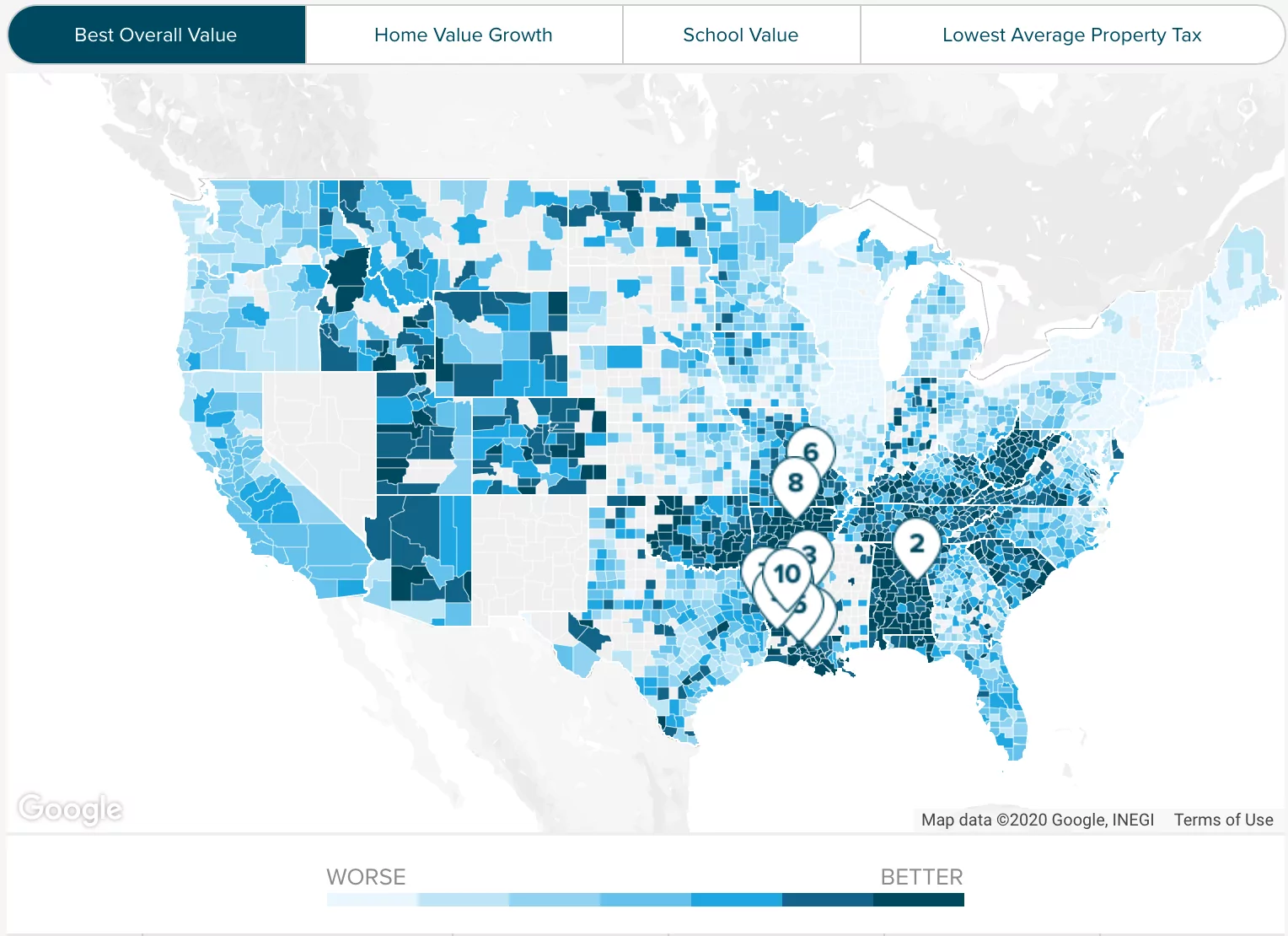

The 2018 United States Supreme Court decision in South Dakota v. Long Island Tax Accounting Advisory Services Inc. In fact New York City suburbs pay the highest taxes in the nation.

Nassau County Tax Lien Sale. Finally a firm that gives you the individual attention that you deserve. For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm.

Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. Long Island school districts 2016-17 tax plans I grew up in. The Sales tax rates may differ depending on the type of purchase.

The new top rate would apply only to people earning over 1 million per year. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. Has impacted many state nexus laws and sales tax collection.

2020 rates included for. 4 rows Currently the sales tax rate in Long Island City is 8875 percent. However effective tax rates in the county are actually somewhat lower than that.

I would refer to Newsday major metro NYC newspaper founded on Long Island for their average Nassau County tax rate chart for 2016. In case you are determined to still live in this part of New York you should find. Lower Property Taxes In Suffolk and Nassau New York Call Heller Tax Grievance for a Free tax grievance application.

The current total local sales tax rate in Long Island. Method to calculate Long Island sales tax in 2021. Assessment Challenge Forms Instructions.

The 8875 sales tax rate in Long Island City consists of 4 New York state sales tax. There are a total of 988 local tax jurisdictions across the state collecting an average local tax of 4229. A copy of the Countys Local Law imposing such tax can be seen here.

Returns with SALT deductions 7200. This is the total of state county and city sales tax rates. The Local Law makes the Nassau County Treasurer responsible for the administration and enforcement of this tax.

You would pay capital gains on that 300000 increase in property value at a 20 tax rate. Three New York counties Nassau Rockland and Westchester had an average. Biden tax plan and real estate.

ZIP code 11003. Answer 1 of 2. The Local Law provides that a tax at the rate of 3 of the per diem rental rate for each room shall be imposed on all rents collected on or after January 1st 2006.

Among the many different counties of New York Suffolk and Nassau counties on Long Island have some of the highest property tax rates both over 2. Our clients can always contact us at our Roslyn Long Island office for. Did South Dakota v.

The Long Island City sales tax rate is. This is the total of state and county sales tax rates.

Florida Property Tax H R Block

States With Highest And Lowest Sales Tax Rates

Nyc Buyer Closing Cost Calculator Interactive Hauseit

New York Paycheck Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

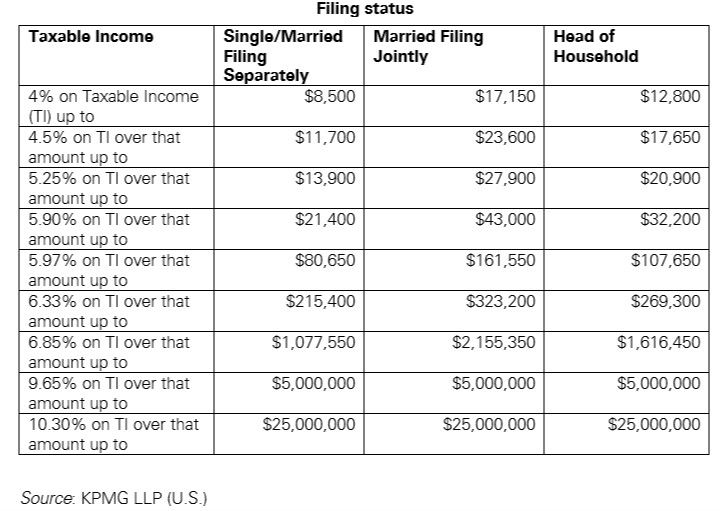

Us New York Implements New Tax Rates Kpmg Global

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

New York Property Tax Calculator Smartasset

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Property Taxes In Nassau County Suffolk County

What Is The Llc Tax Rate In New York Gouchev Law

What To Know Before Moving To Long Island

Why Households Need 300 000 To Live A Middle Class Lifestyle

Property Taxes In Nassau County Suffolk County

Alameda County Ca Property Tax Calculator Smartasset

How To Calculate Capital Gains Tax H R Block

States With Highest And Lowest Sales Tax Rates

Why Households Need 300 000 To Live A Middle Class Lifestyle