how to set up a payment plan for california state taxes

Make monthly payments until my tax bill is paid in full. If you already filed or youre unable to find this option in TurboTax you can apply.

California Inflation Relief Checks 101 What You Need To Know

Pay a 34 setup fee that will be added to my balance due.

. If youre not eligible to set up an automated payment plan you may still be able to set up a payment plan with one of our representatives by calling 8043678045. If you have overdue amounts from activity statements you may be eligible for an. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB.

To set up a payment plan youll need your ABN or TFN and the full details of your outstanding amount. Find the reference number for your Direct Debit. Choose the Budget Payment Plan option and follow the instructions to set up your plan.

Make monthly payment directly from a checking or savings account Individuals only Make monthly. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. As an individual youll need to pay a 34 setup fee.

Processing the application takes 90 days and costs 34 for individuals and 50 for businesses. It means the taxpayer must agree to a monthly payment amount that pays. Select the installment payment plan option Continue and follow the onscreen instructions.

The first plan is designed for individual taxpayers who owe up to 50000 including interest and penalties. We can set up payment plans for both individuals and businesses. After applying for a long-term payment plan payment options include.

You can request a payment plan for any unpaid amount including Cigarette Taxes Homestead Benefit and Senior Freeze Property. To set up a payment arrangement you must provide your date of birth and Social Security number. The Attorney Generals office will accept your request for installment payments for payment plans of up to one year.

How to set up a payment plan with the state of California First visit httpswwwftbcagovonlineeIA and follow the instructions on how to set up the payment. Payment plans may not be for longer than 60 months and the minimum monthly payment is 25. Some states also require you to provide your adjusted gross income which is located.

WELLINGTON New Zealand New Zealands government on Tuesday proposed taxing the greenhouse gasses that farm animals make from burping and peeing as part of a. We Help Taxpayers Get Relief From IRS Back Taxes. The second plan is meant for business entities with tax debts of 25000 or less.

Keep enough money in. In some cases we may. Electronic funds withdrawal EFW.

Tips for setting up your. What you should know about payment plans. Pay by automatic withdrawal from my bank account.

Bank account - Web Pay Free Credit card service fee Payment plan setup fee Check or money order. Youll need to use your 11-character payment reference. How to set up a payment plan for california state taxes Thursday March 17 2022 Edit Average Income Tax Preparation Fees Increased In 2015 Tax Prep Tax Preparation.

The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted. Electronic funds transfer EFT for corporations.

Covered California Income Limits Health For California

Free Payment Plan Agreement Template Word Pdf Eforms

California Sending Out 705 000 Stimulus Payments Of 600 1 100 Next Week Orange County Register

19 Printable Irs Payment Plan Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

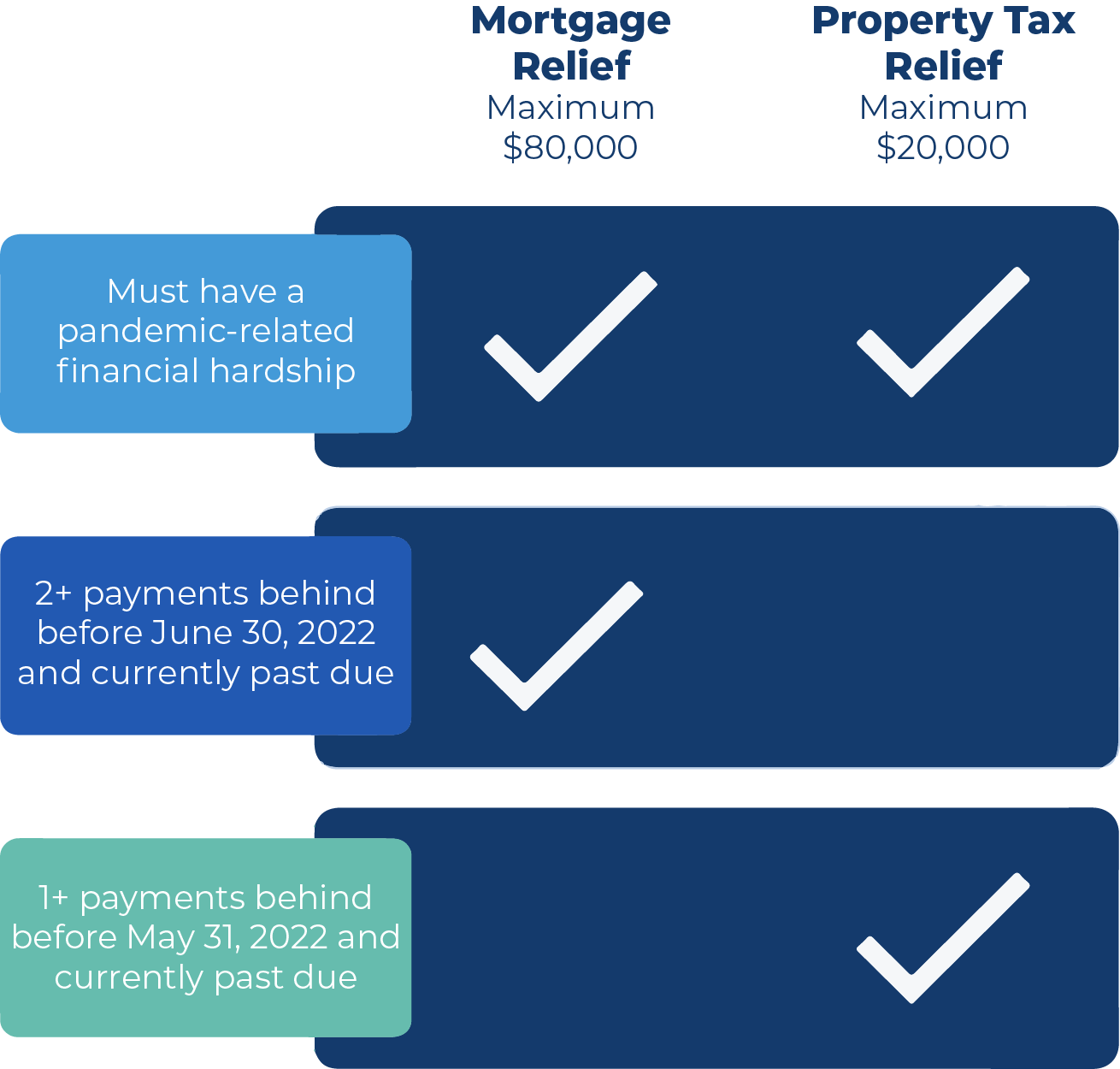

Program Helping California Residents Struggling With Mortgage And Property Tax Payments Abc30 Fresno

Skipping California Ftb Installment Payments

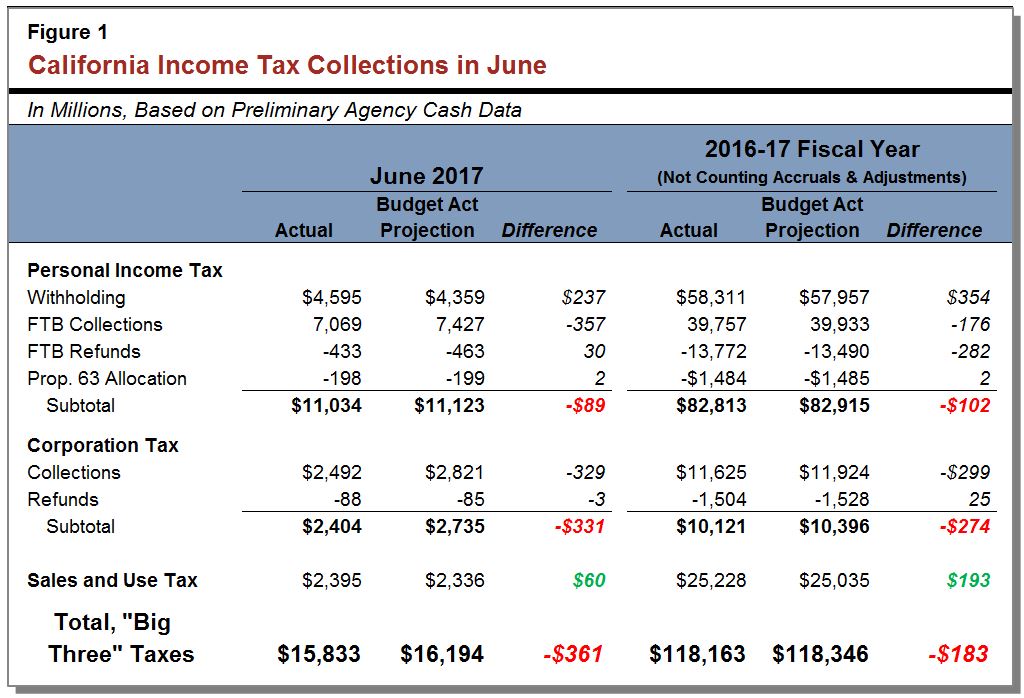

June 2017 State Tax Collections Econtax Blog

California Mortgage Relief Program

Student Financial Services Csu Chico Media

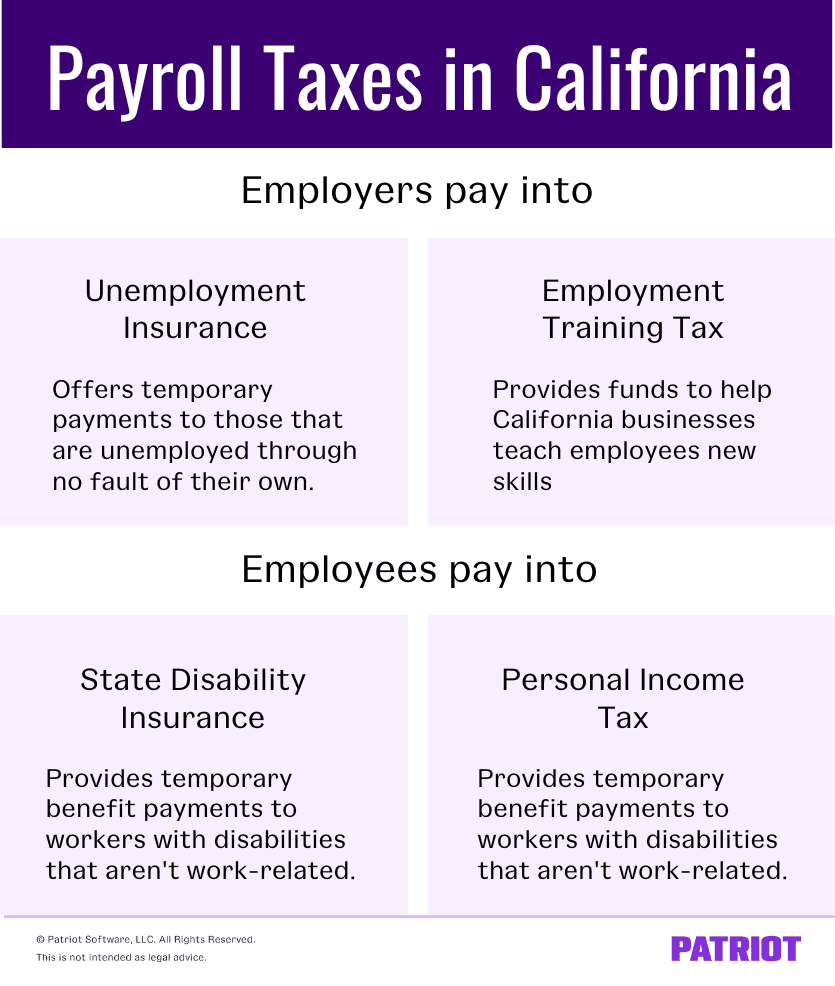

Understanding California Payroll Tax

Largest State Tax Hike Ever Was Likely Just A Down Payment For California S Failed Single Payer Health Plan

California Stimulus How To Track Golden State Payments Marca

Irs Franchise Tax Board Department Of Labor Fasb Aicpa Windes

California Estimated Taxes In 2022 What You Need To Know

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

State Of California Franchise Tax Board The Franchise Tax Board Ftb Today Announced 2 5 Million Golden State Stimulus Gss Payments Worth 1 6 Billion Have Been Issued To Eligible Taxpayers Click The

Ftb Publication 1032 California Franchise Tax Board State Of

California Inflation Relief Payments Worth Up To 1 050 Start Going Out This Week Cnet